Get In Touch

Questions? Please fill this form and our team will get in touch.

The outbreak of the pandemic has caused dramatic changes in the way companies and industries to operate worldwide. Similarly, the financial industry has also changed rapidly overnight, expanding its digital infrastructure to give corporate and retail customers access to banking services 24/7. Most of the world's largest banks have been replaced by the pre-coronavirus trend of incremental change and careful experimentation, accelerating their digital presence. There is an increasing willingness to challenge the business model. If 2020 and 2021 were the years where COVID forced banks to embrace change, 2022 will be the year change is institutionalized and the dawn of the new normal appears.

Several factors contributed to the transformation of the payments industry, including the Covid-19 pandemic, industry consolidation, and customer demand for end-to-end service. With Payments 4.X, the industry enters a new era of embedded, invisible payments that enable frictionless customer experiences.

To cater to the unique necessities of the clients, the eventual fate of banking will be fuelled by digitization, upheld by trendy new-age technology like APIs, enabling the customers in making consistent, secure, and fast payments. Cost proficiency, standardization, and interoperability of the monetary frameworks will be distinct advantages for the business with the following trends driving the banking industry in the coming year:

Reference : (capgemini)

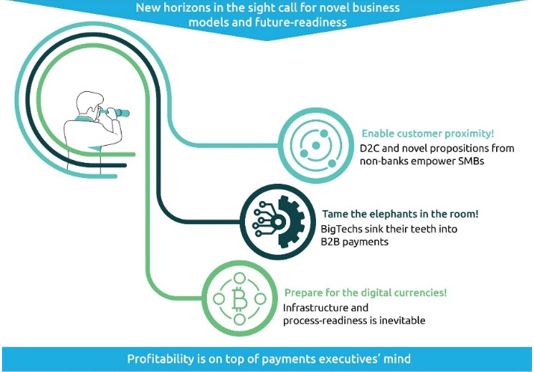

In the above infographic we can look through the new horizons for novel business models through enabling customer proximity, new technological trends, changes in customer behaviour, unprecedented need for next-generation payment methods, and increased emphasis on nimble payment solutions for B2B and SMB segments.

Enhancing the digital banking industry: Most digital banking comprises checking balances, covering bills, and making deposits. These capabilities are progressively being incorporated by major technology companies into a wide range of platforms, including different services such as commerce and social networking. Banks have a few choices, each with its own upsides and downsides. They could add non-banking features to their services and compete straight for customer attention, however that would be an unjustifiable and costly endeavour, viable in only a handful of markets. They can also partner with a super app to offer white label services, but accept that as a junior partner we may compete with our own branded services. A third choice is to pull out from battle and adhere to the conventional franchise. But differentiation can be a challenge, and as super apps increasingly dominate the financial lives of their customers, they will have to accept that the share of conventional transactions will unavoidably decline.

Automated banking systems with self-learning capabilities: An “independent framework” or “self-managing system” learns from its current environment and dynamically alters its own algorithms continuously in real-time to optimize operation in complex ecosystems illustrating the ongoing low-level version of an independent framework. In the future, these systems may even play a role in powering robotic assistants in physical branches. Currently, autonomous systems in the banking context are mostly software-based. Nonetheless, humanoid robots are arising in smart branches, which are examples of hardware-based autonomous systems that serve clients and customers. They can also be utilized in autonomous debt management, individual monetary aids, and automated loans.

Ecosystems of banks are powerful: With the emergence of concepts such as open banking and embedded finance, the idea of banks as ecosystem facilitators has come to the fore. All of these related themes are both business and innovation trends, but like so many banking developments, technological change is the impetus. Banks will play a larger role in the ecosystem over the next few years, providing banking customers access to third-party products and services and facilitating embedded funding. From direct-to-customer sales to complete home-buying services delivered via apps, organizations across industries are acting with the conviction that they can't serve their clients alone. More than just a convenience feature, embedded finance is becoming a must-have for many businesses to deliver the experiences customers increasingly expect.

Bringing innovation back to life: Ten years after the Great Financial Crisis was a period of setbacks, with many banks ditching new product launches and focusing on getting their fundamentals right. New companies and digital challengers have hopped in to infringe, recognizing promising development regions that traditional financial institutions have hitherto ignored. Banks are fighting back with creativity, with the help of improvisation post COVID-19. At the institutional level, banks currently have a clearer comprehension of when to construct, when to purchase, and when to accomplice.

Streamlined and secure payment processes: Customers need consistent, secure, savvy, and quick payments. Frictionless payments give financial institutions an upper hand. By streamlining services and leveraging the maximum potential of new technologies such as blockchain, smart contracts, tokenization, and the Internet of Things (IoT), banks can deliver efficient payment experiences. Fraud prevention and compliance measures are additionally an integral part of payment systems, making it imperative for financial institutions to have vigorous security frameworks set up.

Your email address will not be published. Required fields are marked *